Pre-Launch and Market Context (2023)

Vortex Market emerged during a critical transitional period in the darknet marketplace ecosystem. The closure of Hydra Market in April 2022, once the world's largest darknet marketplace with an estimated $5 billion in annual transactions, created a significant void in the Russian-speaking market. Simultaneously, law enforcement operations targeted major Western marketplaces, resulting in the takedowns of AlphaBay (seized in 2017), Wall Street Market (2019), and DarkMarket (2021).

This enforcement pressure created both challenges and opportunities for new marketplaces. Users sought platforms that learned from predecessors' mistakes, implementing stronger security measures and more resilient infrastructure. The market demanded better operational security, improved user privacy features, and mechanisms to prevent exit scams that had plagued earlier platforms. Vortex Market's founders recognized these needs and designed the platform architecture from the ground up to address these specific concerns.

October 2023: Initial Launch

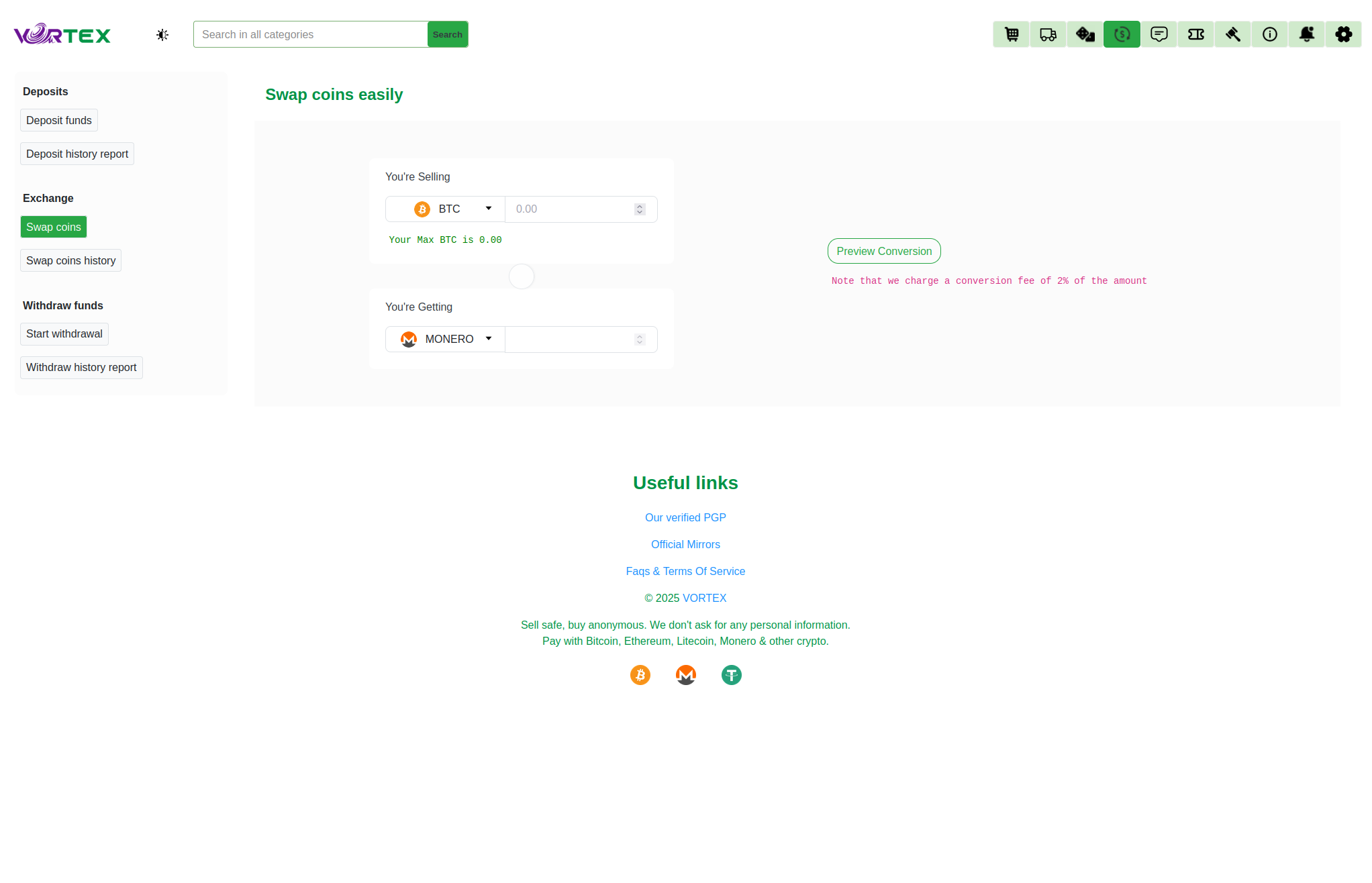

Vortex Market officially launched in October 2023 with a controlled beta testing phase. The initial rollout focused on establishing core infrastructure: multi-signature escrow systems, PGP-encrypted messaging, and six-cryptocurrency support (Bitcoin, Monero, USDT, Litecoin, Ethereum, Zcash). This multi-currency approach immediately distinguished Vortex from many competitors who supported only Bitcoin and Monero or exclusively Monero.

The platform launched with approximately 20-30 vetted vendors selected through a rigorous screening process. These early vendors underwent identity verification, provided substantial bonds (0.5+ BTC), and demonstrated established reputations on other platforms or within trusted communities. This curated approach prioritized quality over quantity, aiming to build trust and avoid the scammer influx that often plagues new marketplaces.

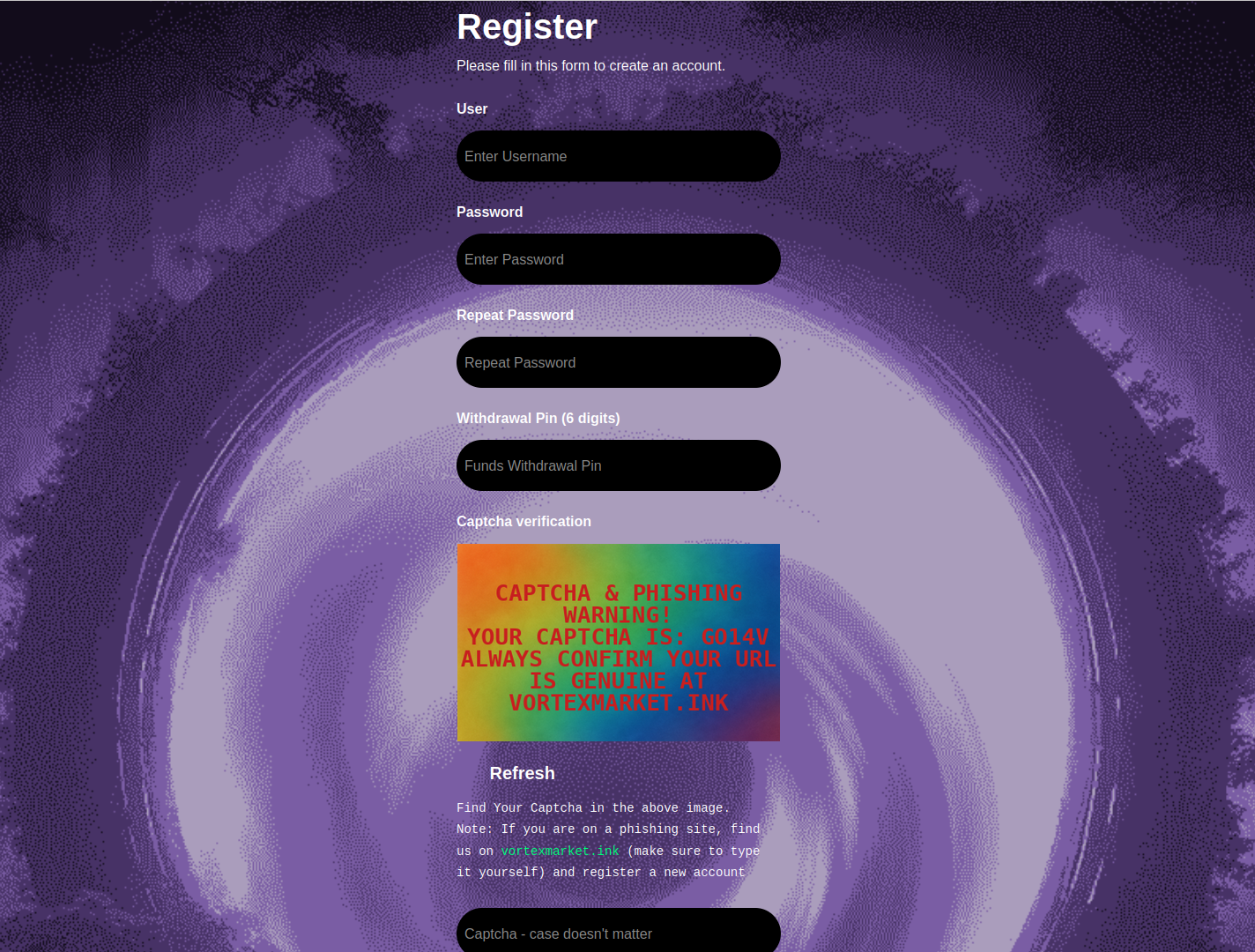

Technical infrastructure at launch included Tor v3 hidden services with 56-character onion addresses, distributed server architecture across multiple jurisdictions, and DDoS protection systems including queue management and rate limiting. The platform's modern codebase, built with contemporary security practices, avoided the technical debt that older marketplaces accumulated over years of reactive patching.

2024: Growth and Expansion

Throughout 2024, Vortex Market transitioned from closed beta to full public operation. The vendor base expanded from 30 to approximately 100-300 active sellers, with product listings growing to 500-2,000 items across multiple categories. Monthly active users increased from hundreds to an estimated 5,000-20,000, with monthly transaction volume reaching $400,000-1,200,000.

The platform implemented several significant feature updates during this growth phase. The vendor reputation system evolved to include five-tier status levels (New Vendor, Trusted, Elite, Verified) with corresponding privileges and requirements. Search and filtering capabilities expanded to include advanced options for price ranges, shipping locations, vendor ratings, and product conditions. The escrow system received enhancements including partial release options for multi-item orders and improved dispute resolution workflows.

However, 2024 also brought challenges. Community forums documented operational issues including escrow management problems, withdrawal delays, and fund mismanagement incidents. These problems resulted in mixed user feedback, with the platform receiving community ratings of 3.5-4.0 out of 5 stars. While many users appreciated the modern interface and multi-currency flexibility, others expressed concerns about administrative competence and financial oversight.

DDoS attacks periodically affected availability, though the platform's protection systems typically enabled recovery within 30-120 minutes. These attacks, common across the darknet marketplace ecosystem, tested Vortex's infrastructure resilience and highlighted areas for improvement in defensive capabilities. The development team responded by implementing enhanced queue systems, improved CAPTCHA challenges, and more sophisticated traffic analysis to distinguish legitimate users from attack traffic.

2026: Current State and Market Position

As of early 2026, Vortex Market occupies the #10-15 position among active darknet marketplaces, placing it in the mid-tier segment. This positioning reflects steady growth but not explosive expansion. The platform serves a dedicated user base that values its multi-currency support and modern security features, though it hasn't yet achieved the scale of established leaders like Torzon (20,000+ listings, 2,000+ vendors).

Recent developments include implementation of quantum-resistant cryptography using lattice-based algorithms and the CRYSTALS-Kyber protocol. This forward-looking security enhancement prepares the platform for the eventual advent of quantum computing, which threatens to break current RSA and elliptic curve cryptography. The hybrid classical-quantum approach maintains compatibility with existing systems while providing future-proof protection.

The community sentiment remains mixed but generally positive among regular users. Forum discussions reveal appreciation for the platform's user interface, cryptocurrency flexibility, and responsive support when issues arise. However, concerns persist about operational stability and competition from more established or specialized platforms. Vortex continues working to address these concerns through infrastructure improvements, enhanced security measures, and refined operational procedures.